Following the 56th GST Council meeting on Wednesday, September 3, 2025, people began debating what’s getting cheaper and what’s set to burn a hole in their pockets. The government has rolled out a major reform of India’s Goods and Services Tax (GST) regime.

From September 22, 2025, the new taxation regime, GST 2.0, will come into effect with three slabs — 5%, 18%, and a special 40% for luxury goods and a select other items. This replaces the 2017 multi-slab structure, which was not only complex but also tough to comply with.

The timing cannot be more interesting. For one, the Centre is looking to nudge domestic spending at a time when the Indian economy is grappling with US tariffs on Indian goods. Even so, the new rates kick in just in time for the festive season.

So, what’s new? Taxes have been slashed on household essentials, medicines, small cars and appliances. Optimism is running high among consumers.

Now, while most seem to be making merry, not everyone’s upbeat, especially foodtech startups. This is because the new tax regime mandates delivery services provided through ecommerce operators to be taxed at 18%.

With this, delivery-first startups are in a pickle. While they are set to witness peak demand during the upcoming festive season, the new GST mandate could stifle their margins.

Now, before we break down what GST 2.0 really means for ecommerce players, let’s look at the top stories from our newsroom this week:

India’s VC Exit Puzzle: Discounted exits have become more common as valuations reset — even for profitable companies — as India’s oldest VC firms rush to close their funds. And with new investors lining up for a piece of IPO-bound companies, it’s raining discounts in the secondary market

India’s Chip Chase: With the launch of Vikram, India’s first space-grade chip, there’s a clear shift from design to semiconductor production. But with gaps in infrastructure and the manufacturing ecosystem, India’s semiconductor ambitions need a mightier push in the next few years

Platform Fee Conundrum: Food delivery giants have latched on to platform fees as a crucial profit lever amid slowing food delivery growth. But the growing dependency also comes with the risk of customer backlash and partner strain, especially with ONDC and Rapido breathing down the neck of Zomato and Swiggy

Swiggy, Zomato White-Knuckle For Another Tax BlowAs the new tax regime comes into force, food delivery platforms are set for a fresh tax blow. The new edict makes them liable for taxes on local delivery services routed through their platforms.

It is important to note that in some orders, there may be no delivery fee at all due to discounts provided by these platforms or their loyalty membership plans.

The GST Council has created a new category called “local delivery services” and split it into two buckets.

- First: General local delivery services, which were already covered under postal and courier services at 18%, with input tax credit available to the service provider

- Second: There’s a new bucket, specifically for the supply of local delivery services through ecommerce platforms

It is the second bucket that changes the equation for food delivery giants. From 22 September, Swiggy, Zomato and other platforms will need to pay 18% GST on delivery charges when the supplier isn’t GST-registered. The supplier in this case is the delivery partner.

To prevent any confusion, these services have been excluded from the “Goods Transport Agency” category.

Speaking with Inc42, Gyanendra Tripathi, partner and leader (West), Indirect Tax at BDO India, said delivery charges have been in a grey zone for years. The law has long said that for services like restaurants, housekeeping, and accommodation, it’s the ecommerce operator and not the supplier who must pay GST.

“The government has now plugged that gap. Come September 22, ecommerce operators will need to pay an 18% GST on delivery charges, in cash, with no option to claim input tax credit.”

Tripathi added that the move could also be about reducing state-level disputes and making the law crystal clear.

Food delivery platforms have long been embroiled in tax disputes over whether GST should apply to delivery charges. Their argument has been simple: if they’re passing on the money from deliveries to their delivery partners, they shouldn’t be liable.

This grey area has now been addressed, leaving no room for any ambiguity.

High Taxes, Thin Margins: Who Pays The Price?For food delivery giants, the new GST regime is a fresh cost burden altogether. Morgan Stanley estimates Zomato could take a hit of around INR 2 per order, while Swiggy’s cost impact is pegged at INR 2.6 per order in FY25. This may not sound much, but if both platforms end up footing the bill, they could together cough up more than INR 350-400 Cr in taxes, according to industry analysts.

“With ongoing expansion expenses and heavy investments in cloud kitchens, neither Zomato nor Swiggy have the might to carry this weight indefinitely. Incentives for delivery partners may also come under pressure,” said Satish Meena, founder of market research and forecasting platform Datum Intelligence.

Not to mention, customers are already feeling the pinch. Swiggy and Zomato have been steadily raising their platform fee for some time now. Just last month, both Swiggy and Zomato hiked their fees again.

Clubbing this hike with an additional 18% GST, which the two foodtech giants may be planning to pass on to consumers, could leave customers with a bad taste, especially during the festive season.

“If delivery costs rise again, demand could take a hit, just as the festive season begins,” Meena added.

An alternative to this will be slashing partner payouts, and needless to mention, that will come with its own set of challenges.

With the advent of GST 2.0, there has been some confusion about whether quick commerce platforms like Blinkit, Swiggy’s Instamart, or Zepto will fall under the ambit of the new taxation regime. That, experts and analysts say, seems unlikely. This is because these players sell goods from their own dark stores

The new mandate primarily impacts service platforms — restaurants and similar businesses charging delivery as a separate line item. “Housekeeping services, if they add a delivery or transport fee, would also be covered,” said Tripathi of BDO India.

In short, only ecommerce operators providing services, not goods, are in the current scope. Section 9(5) of the CGST Act specifically targets service-sector platforms.

“Right now, the spotlight is firmly on Zomato and Swiggy. But the wording of the notification leaves room for the government to extend the rules in the future. Quick commerce platforms could be included down the line,” an executive at a quick commerce platform said.

Once the official notification drops, the picture should be clearer.

Overall, GST 2.0 is set to simplify India’s tax structure and offer relief to consumers, but not everyone is raising a toast. For platforms like Swiggy and Zomato, the new rules mean higher costs and thinner margins, and the ripple effects could be felt across the service sector.

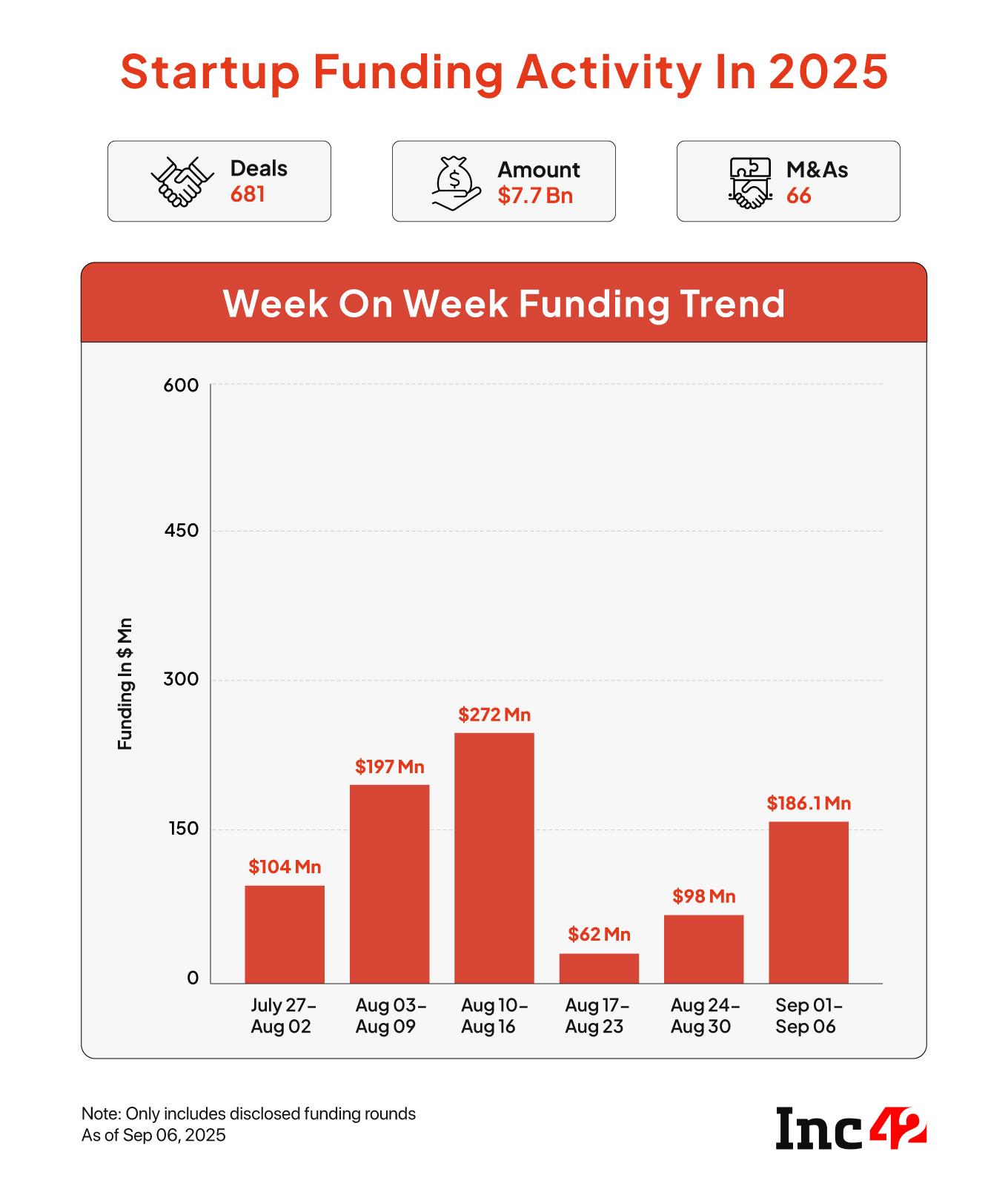

Weekly Funding Revives: Indian startup funding surged in the first week of September, with 20 startups raising $186.1 Mn in six days. This was a sharp 90% jump from the $98.2 Mn raise across 18 deals in the last week of August

Gupshup Sheds Weight As IPO Looms: Gupshup cuts over 100 jobs in another cost-saving move, months after laying off 200 employees. The conversational AI startup is streamlining operations ahead of an IPO while expanding its enterprise AI offerings

Girish Mathrubootham Signs Off: The Freshworks founder is exiting as executive chairman to focus on Together Fund and AI startups. Roxanne Austin will succeed him as the chairperson of the board

BlueStone’s Q1 Scorecard: BlueStone’s maiden financial results as a listed company showed glittering sales blemished by persistent losses. Even though the losses fell sequentially, the company’s plans involve a lot more capital expenditure

Apple’s New India Milestone: The tech giant’s India sales hit a record $9 Bn in FY25, up 13% YoY, led by iPhones. The company is also expanding retail stores and ramping up domestic production to serve global markets

[Edited by Shishir Parasher]

The post Swiggy, Zomato & The GST 2.0 Squeeze appeared first on Inc42 Media.

You may also like

Harry Kane has already revealed Tottenham return stance as Bayern Munich 'braced' for transfer

"EC is working as extension of BJP": alleges Congress MP Akhilesh Prasad

Katie Price, 47, reveals plan to 'lots of babies' despite admitting her 'eggs are f***ed'

Vinted users prepare for frustrating change which some say is 'not fair'

Ganga Aarti performed early in Haridwar temples as Sutak period begins ahead of complete lunar eclipse